Debt mutual funds are taxed at slab rate for gains made within 3 years of investment and at 20 with indexation for gains made after 3 years. Schemes like ELSS has a lock-in of 3 years.

Public Mutual Fund Random Thoughts

Calculate returns for your Employees Provident Fund EPF FD.

. The Employee Provident Fund scheme was launched under the supervision of the Government of India. The minimum investment through the lumpsum route is INR 1000 for some funds and INR 5000 for some. ELSS are Tax Free under Section 80C.

Calculators Budget Budget 2020 Income tax Investment Plan Tax Return Taxes Download Excel based Income Tax Calculator for FY 2020-21 AY 2021-22 incorporating new and existing tax regimeslabs. The second part of EPF is the employee pension scheme EPS. Systematic Investment Plan SIP Route.

We offer a comprehensive range of products comprising conventional and Shariah-based unit trust and PRS funds as well as financial planning services. Public Provident Fund PPF 79. It is a relatively small portion of a minimum of 5 up to 15 of the EPF funds.

This is basically the wealth generation part of the scheme. Public Mutual Berhad a wholly-owned subsidiary of Public Bank is a top private unit trust management company and leading PRS provider in Malaysia. Regular investment in mutual funds on a fixed date is made through the SIP route.

A particular category of mutual funds ELSS funds are eligible for tax deduction under Section 80C for investments up to Rs 15 lakh per annum. Comes under EEE Category Exempt-Exempt. As we grow in life saving for tax or planning for income tax deduction becomes an unavoidable exercise.

For a very long term the Employees Provident Fund has been one of the most widely-used investment schemes by the salaried class in India. MC30 is a curated basket of 30 investment-worthy. However there have been instances where an employer has failed to deposit the same on time.

If the deposit is not made by the employer it is ultimately a loss for an employee. The first part of EPF is where your retirement benefits are accumulated. The plan was introduced with the Employees Provident Funds Act in 1952.

Once the Employees Provident Fund deduction has been deducted from an employees salary an employer must deposit the same in the EPF account within the prescribed time limit. The EPF is not one scheme. A revenue stamp of Re 1 needs to be pasted with the EPF Form 10C.

This scheme makes employees working in the organised sector to be eligible for a pension after their retirement at the age of 58 years. The Employee Provident Fund Organisation EPFO has provided a social security scheme called the Employee Pension Scheme EPS. Track your portfolio 24X7.

To make an additional contribution to the EPF account one can do so via Voluntary Provident Fund VPF. However the rate of returns in case of such schemes is limited. On the other hand market-linked investment schemes like Mutual Funds can generate a considerable amount of gains.

Public Mutual Berhad a wholly-owned subsidiary of Public Bank is a top private unit trust management company and leading PRS provider in Malaysia. Invest in Direct Mutual Funds New Fund Offer NFO Discover 5000 schemes. EPF is a beneficial scheme for investors who are looking to guaranteed returns.

Take your Investment strategy to the next level using Growws online Financial planning Calculators for different investment methods. Indexation reduces the tax liability to account for inflation. For the purposes of managing the Fund and for carrying into effect the purposes of this Act a body corporate by the name of Employees Provident Fund Board is established with perpetual succession and a common seal and which may sue and be sued in its corporate name and.

The EPFO also invests in equity markets through ETFs. The investment in the EPF Scheme gets a tax deduction up to a maximum of Rs 15 lakh per year under opt. Consider EPF Members Investment Scheme.

We offer a comprehensive range of products comprising conventional and Shariah-based unit trust and PRS funds as well as financial planning services. It actually comprises three different schemes with three different objectives. Calculate your returns on Public Provident Fund PPF EPF.

Once the investors invest mutual fund units are allotted in t2 days. Establishment of the Board. However do note that if the contributions via EPF and VPF exceed Rs 25 lakh in a year then the interest earned on it will become taxable.

If an individual is covered Employees Provident Fund EPF then every month same is deducted from hisher salary. Government of India allows you to save tax under Section 80C 80D 80EE You can claim tax deduction up to 15 lakh under Sec 80C additionally you can save 25000 50000 for senior citizens under Section 80D and 50000 under Section 80EE. Invest In MC 30.

Investors with moderate to high risk appetite. PART II THE BOARD AND THE INVESTMENT PANEL.

Best Tax Free Bonds To Invest In 2020 Tax Free Bonds Investing Tax Free

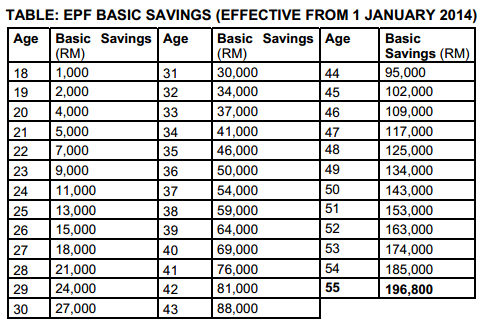

The Impact Of The New Basic Savings Table For Epf Members Investment Scheme Effective Jan 2014 Myunittrust Com

The Employee Provident Fund Epf Also Simply Called As Provident Fund Pf Is The Most Popular And Default Inves Financial Planning Investing Private Sector

How To Calculate Sip Maturity Amount In 2022 Maturity Calculator Amounts

Important Dates Deadlines For Aadhaar Linking With Pan Mutual Funds Insurance Policies Mobile Sim Investment In India Important Dates Mutuals Funds

How To Invest In Unit Trust With Epf Money Kwsp I Invest I Sinar Youtube

Uneedtrust Where Trust Is Mutual

Provident Funds Come In Two Kinds The First Is The Employees Provident Fund Or Epf And The Second Is The Public Prov Public Provident Fund Mutuals Funds Fund

Nps Vs Ppf Vs Epf Vs Mutual Fund Vs Elss Youtube Mutuals Funds Investing For Retirement Public Provident Fund

Deciding Your Investment Instrument Personal Financial Planning Investing Insurance Investments

After Reducing Epf Interest Rate To 8 1 Epfo Wants Increase Equity Investment Limit To 25

The Employee Provident Fund Epf Also Simply Called As Provident Fund Pf Is The Most Popular And Default Investment Desti Private Sector Finance Investing

Financial Assets Savings Of The Households 2012 2018 Financial Asset Investment In India Investing

A Sip Is A Mode Of Investment Where You The Investor Invests A Pre Determined Amount On A Monthly Basis On A Pr Financial Planning Investing Financial Goals

A Complete Guide To Epf Members Investment Scheme Best I Invest Fund Youtube

Eps Vs Nps Vs Apy Comparison How To Find Out Retirement Planning Retirement Benefits